Forced Labor Turkmen Cotton in Global Supply Chains

How Turkmen Cotton Enters Global Supply Chains

Published on June 12, 2023

Turkmenistan is the 10th-largest cotton producer in the world and has a vertically integrated cotton industry.*

In 2022, Turkmenistan exported cotton and cotton products valued at almost US$300 million. Yarn exports made up approximately 45% of the total exports of textile products.

Brands and retailers face the risk of cotton made with state-imposed forced labor in Turkmenistan entering their cotton supply chains at all stages of production.

Suppliers in third countries, in particular Turkey, but also Pakistan and Italy, use cotton, yarn, and fabric originating in Turkmenistan.

Turkmenistan does not import cotton, which means that all cotton products exported by Turkmenistan are made with cotton produced within a state-imposed forced labor system. This repressive system makes it impossible for brands and retailers to conduct any credible due diligence on the ground to prevent or remedy forced labor.

For this reason, to comply with laws governing supply chains and imports, such as the Withhold Release Order against Turkmen cotton in the US, the import ban on forced labor products in Canada, and upcoming forced labor legislation in the European Union, companies must map out their entire textile supply chains, down to the raw material level, and eliminate all cotton originating in Turkmenistan.

To ensure a level playing field and achieve forced labor-free supply chains, governments should enforce import bans against forced labor products where they exist, enact similar legislation in other jurisdictions, and ensure that import control mechanisms are complemented by human rights due diligence obligations on companies to map their supply chains and exclude forced labor cotton.

In an effort to strengthen transparency and accountability practices in global supply chains, and increase the pressure on the Turkmen government to reform its system, the Cotton Campaign hosts the Turkmen Cotton Pledge for brands and suppliers.

By signing the Pledge, companies commit to not use Turkmen cotton in their products as long as it is produced with state-imposed forced labor.

The text on this page covers excerpts from chapters 7 and 8 in the report “Time For Change: Forced Labor In Turkmenistan Cotton 2022”.

* Based on data made available by ICAC for season 2022/2023: https://icac.shinyapps.io/ICAC_Open_Data_Dashboaard/#. The analysis in this chapter of the report is based on data downloaded from UN Comtrade, OEC, and Panjiva, Apr. 2023.

Data caveat: UN Comtrade, 2022 data: HS codes 5201 for “cotton”, 5205 for “yarn”; 5208 and 5209 in aggregate for “fabric”, and 610510, 610910, 620130, 620112, 620192, 620130, 630221, 630231, 630251, and 630492 in aggregate for “finished goods”. In UN Comtrade, there is no data available for imports in 2022 of cotton products from Turkmenistan into Pakistan. The data presented in the map is based on trade information made available through Panjiva, which is not exhaustive. Similarly, there is no data available in UN Comtrade for imports in 2022, of i) cotton products from Turkmenistan into Russia and Belarus, and ii) cotton yarn from Turkmenistan into Italy and Portugal. However, as shown by the Pakistan example noted above, a lack of available data for 2022 does not necessarily mean that imports of cotton products from Turkmenistan have discontinued.

Trade Flows Allowing Turkmen Cotton to Enter Global Markets

Research by the Cotton Campaign coalition on commercial trade and supply chain databases, including UN Comtrade, OEC, and Panjiva, reveals the following trade flows through which forced labor Turkmen cotton and cotton products enter global supply chains and markets:

1) Through suppliers in other countries that produce textiles using Turkmen cotton, yarn, and fabric.

Turkey is the #1 producer of garments and textiles using Turkmen cotton, yarn, and fabric. In 2022, Turkey imported from Turkmenistan: yarn valued at almost US$123 million, cotton fiber valued at over US$50 million, and fabric valued at over US$35 million.

Since Turkey is the third-largest textiles supplier to the EU, the brands retailing in the EU are at particular risk of using Turkmen cotton in their products.

Pakistan is another major producer of garments and textiles using cotton from Turkmenistan. In 2022, Pakistan imported cotton and fabric from Turkmenistan valued at almost US$18 million.

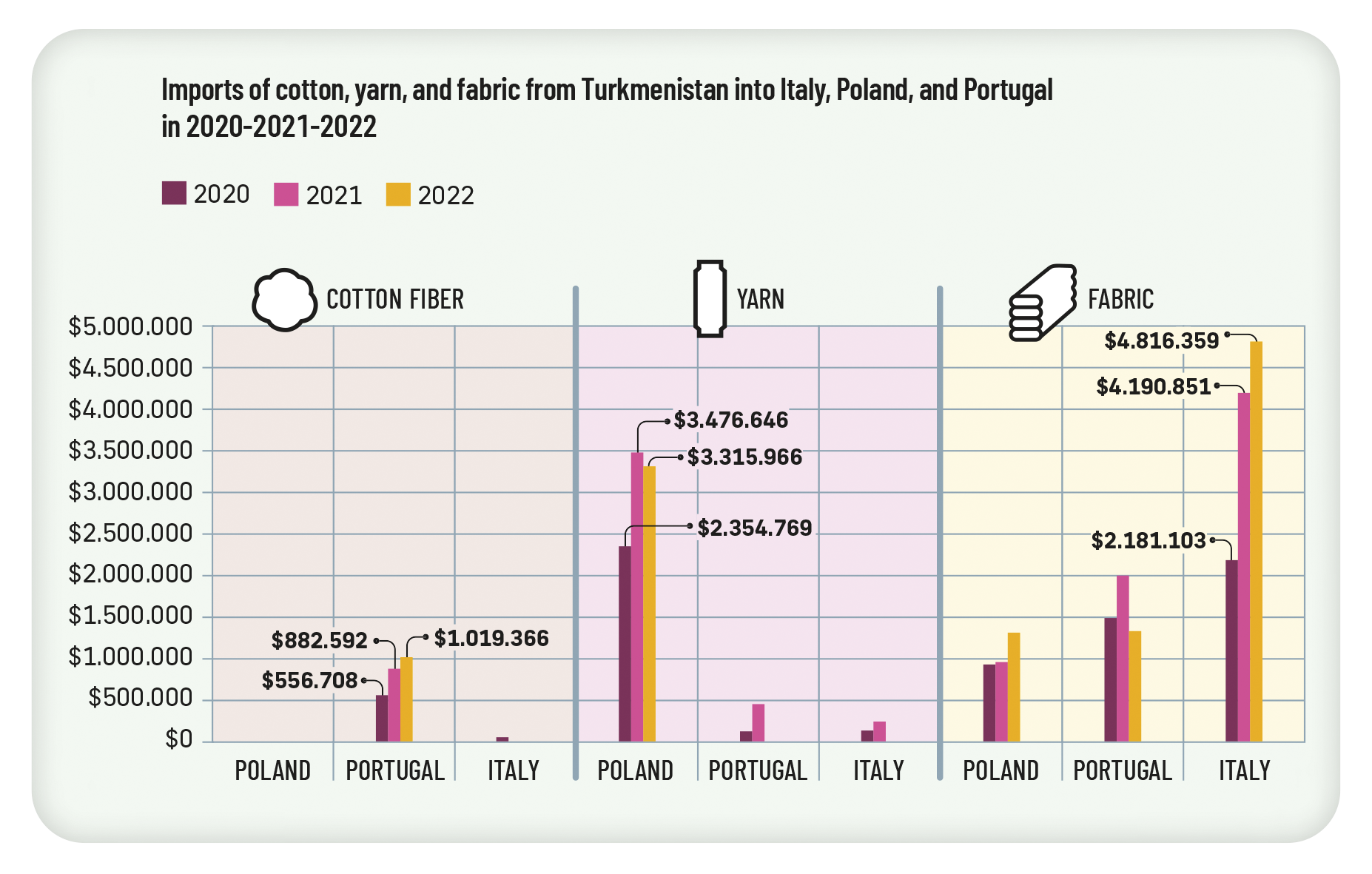

Italy, Poland, and Portugal are key European producers that use Turkmen cotton semi-finished products. In 2022, Italy imported fabric from Turkmenistan valued at almost US$5 million; Poland imported yarn from Turkmenistan valued at almost US$3.5 million; and Portugal imported cotton fiber from Turkmenistan valued at US$1 million.

2) Entering global markets as finished goods produced in Turkmenistan and imported through direct trade routes or as rerouted shipments.

The top three importers of cotton finished goods (home textiles and garments) from Turkmenistan are Russia, Belarus, and Kyrgyzstan.

However, Turkmen cotton textiles also enter the European and North American markets, in violation of import bans, national laws governing human rights due diligence and supply chains, and the brands’ commitments to not using forced labor in their supply chains, in accordance with the UN Guiding Principles on Business and Human Rights (UNGPs) and the OECD Due Diligence Guidance for Responsible Supply Chains in the Garment and Footwear Sector.

Italy is a key European importer of cotton finished goods from Turkmenistan. In 2022, Italy imported bed linens from Turkmenistan valued at almost US$700,000.

In 2022, cotton bed linens valued at US$103,000 were imported directly from Turkmenistan into Canada. Research also shows that home textiles produced using Turkmen cotton were shipped to Canada in 2020, 2021, and 2022 via the US, where the US Customs and Border Protection (CBP) introduced in 2018 a Withhold Release Order (WRO) against products made in whole or in part with Turkmen cotton.

Despite the existing ban on cotton imports from Turkmenistan in the US, products made with forced labor Turkmen cotton are being sold on e-commerce platforms in the US such as K-mart and Sears.

Retailing in the US: compliance with the Uyghur Forced Labor Prevention Act (UFLPA) is an opportunity to eliminate Turkmen cotton from supply chains

Companies retailing in the US have an obligation to comply with the UFLPA. Under the UFLPA, companies are required to map their supply chains to the raw material level and exclude all goods made in whole or in part in the Xinjiang Uyghur Autonomous Region. Brands and retailers alike should also use this opportunity to trace and eliminate Turkmen cotton from their products, at all stages of production.

Manufacturing Hubs Using Cotton, Yarn, and Fabrics From Turkmenistan

1. Turkey

UN Comtrade, 2020-2021-2022 aggregate data, imports from Turkmenistan, HS codes 5201, 5205, 5208, 5209

Facilities in Turkey, Open Supply Hub, https://opensupplyhub.org/facilities?countries=TR§ors=Apparel§ors=Home%20Textiles§ors=Textiles (filtering to include only the following sectors: apparel, home textiles, and textiles) [last accessed May 2023].

Turkish textile manufacturing is a primary gateway for products made with Turkmen cotton, yarn, and fabric. Since Turkey is the third-largest textiles supplier to the EU, the brands retailing in the EU are at particular risk of using Turkmen cotton in their products.

According to publicly available data on Open Supply Hub, as of May 1, 2023, there are over 22,000 facilities producing apparel and (home) textiles in Turkey. Note that this list is not exhaustive, as Open Supply Hub only publishes supplier data voluntarily made available by companies

2. Italy, Poland, and Portugal

UN Comtrade, 2020-2021-2022 aggregate data, imports from Turkmenistan, HS codes 5201, 5205, 5208, 5209. No data was available for the following: imports of yarn into Portugal and Italy in 2022; imports of cotton into Italy for 2021 and 2022; imports of cotton into Poland for the period 2020-2022.

Facilities in Italy, Poland, and Portugal, Open Supply Hub, https://opensupplyhub.org/facilities?countries=IT&countries=PL&countries=PT§ors=Apparel§ors=Home%20Textiles§ors=Textiles (filtering to include only the following sectors: apparel, home textiles, and textiles) [last accessed May 2023].

Italy, Poland, and Portugal are key European producers using Turkmen cotton semi-finished products

According to publicly available data on Open Supply Hub, as of May 1, 2023, there are over 6,000 facilities producing apparel and (home) textiles in Italy, Poland, and Portugal.

This data also shows that brands from around the globe, including from the EU and US, have significant exposure to these facilities. Note that this list is not exhaustive, as Open Supply Hub only publishes supplier data voluntarily made available by companies.

3. Pakistan

Records made available in Panjiva trade database show that between 2021-2023, cotton and semi-finished cotton products valued at US$31 million were exported from Turkmenistan to various spinning and textile mills in Pakistan.

Specifically, Pakistan suppliers Homecare Textiles, Kam International, and Liberty Mills imported the largest quantities of cotton and semifinished cotton products from Turkmenistan over the period noted, each importing cotton goods valued at approximately US$4 million. According to publicly available data on Open Supply Hub, which is not exhaustive, brands from around the globe, including major European and US fast fashion retailers, source from one or more of the three suppliers noted, meaning that they have exposure to forced labor Turkmen cotton being used in the production of their goods.*

*As of May 2023: Homecare Textiles, OS ID: PK2020191YQMSQ3, Open Supply Hub, https://opensupplyhub.org/facilities/PK2020191YQMSQ3?q=homecare&countries=PK; Kam International, OS ID: PK20191720K5JNG, Open Supply Hub, https://opensupplyhub.org/facilities/PK20191720K5JNG?q=kam&countries=PK; Liberty Mills Limited, OS ID: PK20211667P6DHE, Open Supply Hub, https://opensupplyhub.org/facilities?countries=IT&countries=PL&countries=PT§ors=Apparel§ors=Home%20Textiles§ors=Textiles

**For more information on new traceability solutions, see Better Cotton Trials Innovative Traceability Solutions in India, Better Cotton (Apr. 18, 2023), https://bettercotton.org/better-cotton-trials-innovative-traceability-solutions-in-india/; Developing a Traceability Solution for Better Cotton, Better Cotton (Aug. 15, 2022), https://bettercotton.org/developing-a-traceability-solution-for-better-cotton/

*** “Better Cotton Claim Unit (BCCU) is a BCI-specific unit that measures the volume of Better Cotton sourced by supply chain actors, retailers, and brands. One BCCU represents one kilogram of physical Better Cotton sourced from a ‘BCI gin’.” Terms and Conditions, Better Cotton, https://bettercotton.org/membership/better-cotton-platform/terms-and-conditions-better-cotton-platform-access-for-non-bci-members [last updated Nov. 26, 2020]; Find Members: Pakistan, Better Cotton, https://bettercotton.org/membership/find-members/?_sft_member_country=pakistan [last accessed May, 2023].

Brands cannot credibly mitigate the risk of using forced labor Turkmen cotton in their products, through licensing and certification schemes that employ a “mass balance” system

Using schemes such as Better Cotton and Cotton Made in Africa does not and will not mitigate the risk of using cotton made with state-imposed forced labor, such as in Turkmenistan or in the Uyghur Region in China, unless and until they require physical traceability for cotton grown on licensed farms.**

Using a “mass balance” system means that bales of licensed cotton are not fully traceable within the global supply chain. For example, cotton licensed by Better Cotton that does not originate in Turkmenistan can be substituted or mixed at the spinning or fabric production levels with cotton (or cotton products) originating in Turkmenistan, and still be labeled as “Better Cotton”. This is a real risk for all producers and suppliers throughout the supply chain that use cotton inputs from Turkmenistan. For example, two of the Pakistani entities noted above are Better Cotton members, yet sourcing Better Cotton “Claim Units” from those mills does not guarantee brands that Turkmen cotton is not used in their products.***

To ensure that forced labor Turkmen cotton is eliminated from global supply chains, licensing and certification schemes should introduce physical traceability of licensed cotton to ensure cotton originating in Turkmenistan cannot pass as licensed cotton.

Cotton Home Textiles and Garments Produced in Turkmenistan Entering Global Markets

1. US E-Commerce Marketplaces

Despite the existing WRO against products made in whole or in part from cotton originating in Turkmenistan, home textiles made with forced labor Turkmen cotton continue being sold on e-commerce platforms in the US. For example, K-mart and Sears — two major US retailers — sell “Context” brand towels with the description “made in Turkmenistan.”

On its US site, Amazon sells “MS Rugs” brand towels, listed as produced by manufacturer “Ashgabat dokuma teksili”, which is based in Ashgabat, Turkmenistan. These towels are available for delivery worldwide, not just in the US.

In 2021, the Cotton Campaign wrote letters to Overstock and Wayfair, requesting they remove Turkmen cotton products from their websites and take additional measures to prevent goods tainted with forced labor from entering their supply chains. Following the letters, it appeared that both companies removed Turkmen-origin cotton products from their platforms. However, Overstock resumed selling Turkmen cotton towels in 2022. On July 18, 2022, the Cotton Campaign made this information public to journalists and policymakers during the launch of the 2021 report on forced labor in Turkmenistan. A week later, Overstock again apparently removed the Turkmen cotton towels from its platform.

The Cotton Campaign is engaging with CBP for stronger enforcement of the WRO against Turkmen cotton.

2. Italy

UN Comtrade, 2020-2021-2022 aggregate data, imports from Turkmenistan, HS codes 630221, 630231.

Italy is a key European destination for cotton finished goods made in Turkmenistan. While imports of cotton finished goods from Turkmenistan decreased in 2022 from 2021, it is extremely concerning that brands retailing in Italy are importing garments and home textiles directly from Turkmenistan, despite all publicly available information about the state-imposed forced labor situation there.

This shows a gross lack of conducting even the most basic human rights due diligence in their selection of finished goods (“Tier 1”) suppliers. The proposed forced labor regulation that is under discussion at the EU level, in combination with the Corporate Sustainability Due Diligence Directive, has the potential to hold these companies to account for profiting from forced labor, and block imports of products made with forced labor into Italy — and the wider EU market.

Imports Bans on Forced Labor Products and Mandatory Human Rights Due Diligence

As a result of robust and ongoing human rights advocacy at both national and international levels, the imports or sale of products made with forced labor are prohibited in increasingly more jurisdictions.

To comply with these bans, in addition to national corporate due diligence and liability laws, companies must map their supply chains to the raw material level to ensure there is no forced labor at any stage of production.

Because the government of Turkmenistan maintains total control of cotton production and uses systematic state-imposed forced labor to harvest cotton, brands and retailers cannot prevent or remediate forced labor in the country.

For this reason, to comply with their legal requirements, companies must eliminate all cotton originating in Turkmenistan from their supply chains.

LEGISLATION IN FORCE

US: Withhold Release Order (WRO) against Turkmen cotton, in effect since 2018. In 2016, the Cotton Campaign and its partners submitted a petition to exclude all cotton products made in Turkmenistan from the US due to the state-imposed forced labor system in cotton production. The CBP subsequently issued a WRO against Turkmen cotton in May 2018, becoming the first country- or region-wide WRO to exclude an entire commodity.

US-Mexico-Canada region: The United States-Mexico-Canada Agreement (USMCA) prohibits forced labor products from entering the signatory countries.147 In July 2020, Canada introduced corollary legislation that bans imports of goods manufactured wholly or in part by forced labor.

The Cotton Campaign is engaging with US Trade Representatives, CBP, and their Canadian counterparts for stronger enforcement of import bans on forced labor products and to ensure that shipments containing Turkmen cotton that are denied entry in the US are not rerouted to Canada.

France: The Corporate Duty of Vigilance Law, which applies to parent and outsourcing companies, has been in effect since 2017.

Germany: The Supply Chain Act creates due diligence obligations for German businesses to identify and account for their impact on human rights in their supply chains, and has been in effect since 2023.

Norway: The Transparency Act regulates business transparency and human rights and decent working conditions, and has been in effect since 2022.

PROPOSALS

European Union: A forced labor regulation has been proposed to ban the imports, sales, and exports of forced labor products within the EU. This would complement and reinforce upcoming human rights due diligence and corporate accountability legislation under the Corporate Sustainability Due Diligence Directive.

In September 2022, the European Commission published a proposal for a law that will prohibit products made with forced labor from being sold in, imported to, or exported from the EU. To ensure the law will be effective in blocking imports of all products made in whole or in part with cotton originating in Turkmenistan, the Cotton Campaign Coalition has called on EU policymakers to ensure the legislation allows for a regional scope. In practice, this would ensure that bans can be introduced against products from entire industries or regions, such as cotton from Turkmenistan.

Australia: An amendment to the Customs Act, which would introduce a ban on the import of goods produced by forced labor into Australia.

New Zealand: The country launched a public consultation in 2022 on legislation addressing slavery and worker exploitation, which would be achieved through the creation of due diligence and reporting requirements for businesses.

Recommendations

Governments should:

Introduce import control measures to prohibit the import of cotton products originating in Turkmenistan or containing Turkmen cotton.

Introduce tracing mechanisms and transparent customs data to enable the monitoring of imports of Turkmen cotton or goods produced with Turkmen cotton.

Ensure trade and development policies do not inadvertently support or enable the continuation of the state-imposed forced labor system. Introduce mandatory human rights due diligence and transparency laws, which require all forms of business enterprises (including textile companies, cotton traders, and financial institutions) to undertake human rights due diligence in their supply chains, and to map and disclose all tiers of their supply chains.

In particular, the US Customs and Border Protection Agency (CBP) should:

Detain all shipments of goods containing cotton products from Turkmenistan.

Develop a strategy to identify and review shipments of cotton products from suppliers in third countries — including but not limited to Turkey, Pakistan, Poland, and Italy — that import cotton and semi-finished cotton goods from Turkmenistan. The onus should be on importers to show that they have no exposure to Turkmen cotton.

Publish the list of detentions made and the value of the shipments detained under the WRO against Turkmen cotton, which has been in effect since 2018.

Work together with the office of the US Trade Representatives, Canada Border Services Agency, and Employment and Social Development Canada to encourage enforcement of the labor provisions of the USCMA and ensure that products subject to the WRO over Turkmen forced labor cotton allegations are not permitted to enter Canada.

Share information and proactively engage with civil society organizations and experts in supply chain research, including the Cotton Campaign and its partners, to enhance efforts to trace Turkmen cotton in the value chain and identify points of entry into the US.

In particular, the Canada Border Services Agency should:

Publicly recognize cotton goods originating in Turkmenistan or containing Turkmen cotton as goods produced with state-imposed forced labor and introduce a country wide ban against cotton from Turkmenistan, similar to the US WRO.

Detain all shipments of goods made with cotton products from Turkmenistan. Develop a strategy to identify and review shipments of cotton products from suppliers in third countries — including but not limited to Turkey, Pakistan, Poland, and Italy — that import cotton and semi-finished cotton goods from Turkmenistan.

The onus should be on importers to show that they have no exposure to Turkmen cotton. Publish the list of detentions made and the value of the shipments detained under the Customs Tariff item No. 9897.00.00.

Work together with US and Mexico counterparts to ensure enforcement of the USMCA forced labor provisions and that products subject to the US WRO over Turkmen forced labor cotton allegations are not permitted to enter Canada.

Share information and proactively engage with civil society organizations and experts in supply chain research, including the Cotton Campaign and its partners, to enhance efforts to trace Turkmen cotton in the value chain and identify points of entry into Canada.

In particular, EU institutions should:

Address the gaps and loopholes in the proposed forced labor regulation to effectively ban products made by forced labor from entering the EU market, specifically:

Ensure that the proposed legislative instrument is enforceable on a regional basis, such as against Turkmenistan, and also against specific entities, manufacturers, importers, and groups thereof.

Publicly recognize cotton goods originating in Turkmenistan or containing Turkmen cotton as goods produced with forced labor and ensure these products are covered in the scope of the import ban.

Include mechanisms to liaise and coordinate with authorities in other jurisdictions, i.e., Canada and the US, to share evidence and investigation processes, and align enforcement procedures.

Regarding the EU’s proposed Corporate Sustainability Due Diligence Directive, with the trilogue negotiations between the Commission, Parliament, and Council, the EU must ensure that the strength of the final text of the directive is not diluted, and that it contemplates an effective implementation and monitoring process that puts affected people at its center.

Take steps to amend the Union Customs Code to ensure the transparency and public accessibility of customs data. This would enhance the efforts of civil society organizations to monitor the global supply chains; trace products made with forced labor, including Turkmen cotton; and strengthen enforcement of the aforementioned legislation.

Consult with civil society organizations and experts in state-imposed forced labor and human rights due diligence, including the Cotton Campaign and its Turkmen NGO partners, in the process of developing both the forced labor instrument and the Corporate Sustainability Due Diligence Directive.

Brands and retailers should:

Sign the Turkmen Cotton Pledge and publicly commit to not use cotton from Turkmenistan while it is produced with state-orchestrated forced labor.

Immediately terminate any direct sourcing relationships with suppliers in Turkmenistan.

Fully map the brand’s supply chains to the raw materials level and eliminate cotton originating in Turkmenistan.

Establish a legally-binding policy that prohibits the use of cotton from Turkmenistan in the brand’s products, and publish the policy on the brand’s website. Include this requirement in all of the brand’s purchase orders with finished goods suppliers, as well as in relevant contractual instruments governing the supply of manufacturing inputs, including cotton. This necessitates going beyond existing references to “zero tolerance of forced labor” or other similar language in supplier requirements.

Engage suppliers, including mid- and low- tier suppliers, to ensure their policy compliance with the requirement to not use Turkmen cotton. In accordance with the OECD Guidelines, if specific suppliers have failed to mitigate the risk of using Turkmen cotton, it is best practice to terminate the business relationship.

Verify compliance with the policy on cotton from Turkmenistan, and ensure purchasing practices support its implementation.

Publish all suppliers in the brand’s cotton supply chains, including those beyond Tier 1.

Take steps to remediate harms caused by selling goods produced with forced labor, including by publicly condemning trade in these goods, and engaging with the Cotton Campaign to support efforts to end forced labor in Turkmenistan.

Investors should:

Urge companies that use cotton to sign the Turkmen Cotton Pledge and publicly commit to not using Turkmen cotton in their products.

Urge companies to address current or potential links to the forced labor systems of cotton production in Turkmenistan in the companies’ operations and supply chains.

Cease investments in companies that refuse to discontinue using cotton from Turkmenistan while it is produced with forced labor.

Support the advocacy efforts of the Cotton Campaign and its partners, and publicly endorse calls to policy makers and international organizations to take stronger action against forced labor in cotton production in Turkmenistan.